DIGI INTERNATIONAL (DGII)·Q1 2026 Earnings Summary

Digi International Beats Q1 Estimates, Stock Falls 12% on Margin Concerns

February 4, 2026 · by Fintool AI Agent

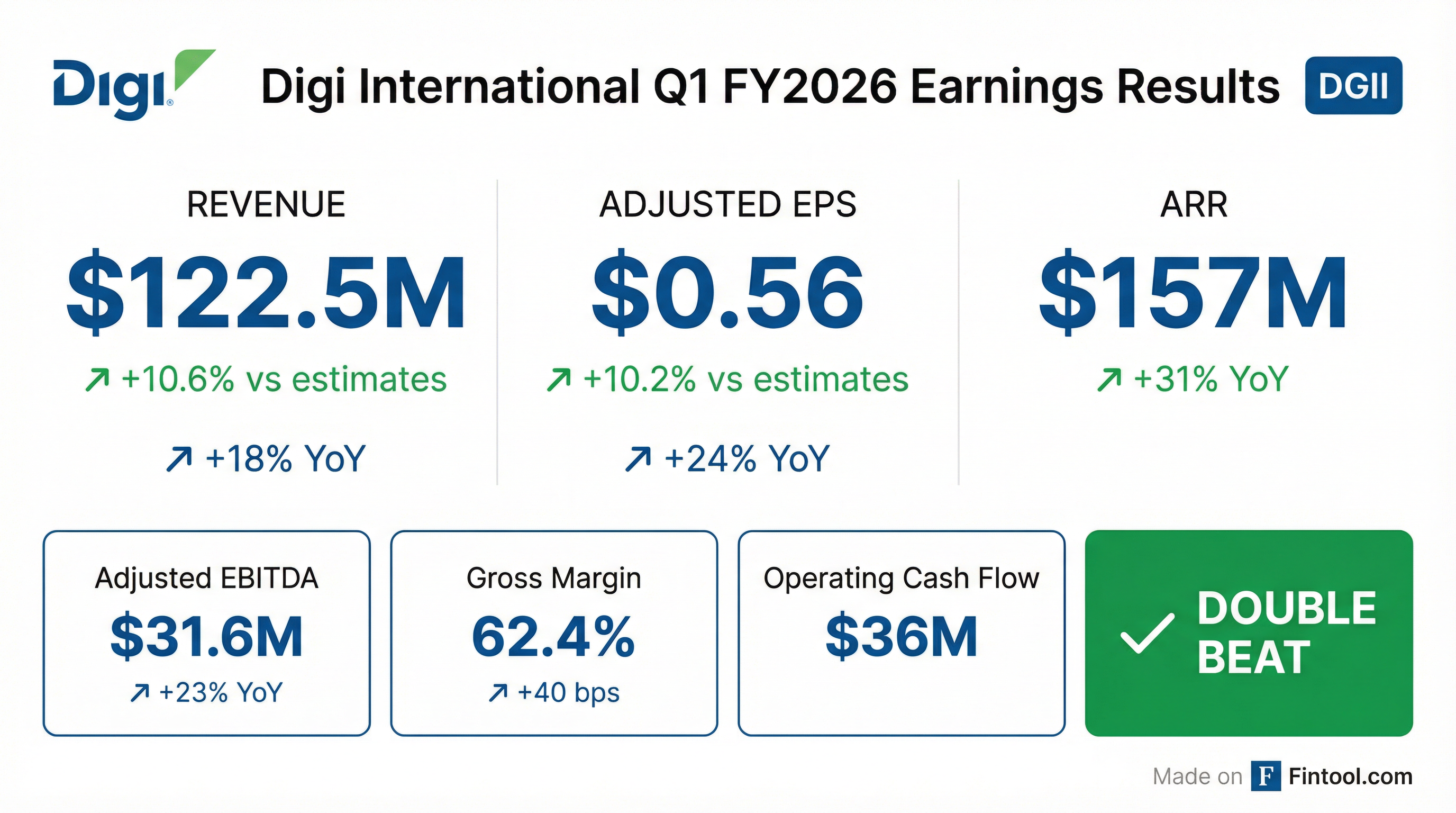

Digi International (DGII) delivered a strong double beat in Q1 FY2026, posting record quarterly revenue of $122 million — up 18% year-over-year and above consensus estimates. The IoT solutions provider beat adjusted EPS estimates, reporting $0.56 per share. The outperformance was driven by the Jolt acquisition completed in August 2025 and continued momentum in recurring revenue, with ARR reaching $157 million (+31% YoY) — marking the "fifth consecutive quarter of double-digit growth." Adjusted EBITDA hit a record $32 million (+23% YoY) with a 25.8% margin. Despite the beat, shares fell ~12% in after-hours trading as investors digested gross margin compression and memory pricing concerns.

Did Digi International Beat Earnings?

Yes — a clean double beat with strong margins:

Gross profit margin expanded 40 basis points to 62.4%, while operating margin improved 40 basis points to 13.3%. Cash flow from operations was robust at $36 million, compared to $30 million in Q1 FY2025.

Important note on adjusted EPS methodology change: Starting Q1 FY2026, Digi now includes interest expense in adjusted net income calculations. This was previously excluded when the company "operated without structural debt." The change reduces adjusted EPS by approximately $0.05-0.06 per share but provides "a more comprehensive view of operating performance."

What Drove the Beat?

The Jolt acquisition was the primary catalyst. The August 2025 acquisition contributed meaningfully to both segments:

IoT Products & Services Segment

- Revenue: $86 million (+11% YoY)

- ARR: $34 million (+26% YoY)

- Operating margin: 13.5% (-60 bps), pressured by higher inventory-related expenses

Growth came from "a $6.3 million increase in one-time sales and $2.2 million of recurring revenue growth, with no material impact from pricing."

IoT Solutions Segment

- Revenue: $36 million (+39% YoY)

- ARR: $123 million (+32% YoY)

- Operating margin: 12.9% (+370 bps)

The Solutions segment saw "$7.6 million increase in recurring revenue and a $2.5 million increase in one-time sales, both driven primarily by the Jolt acquisition." The sharp margin expansion came from "favorable operating expense leverage and a higher proportion of volume from recurring revenue, which has a higher margin."

What Did Management Guide?

Digi provided bullish guidance reflecting both organic momentum and the January 2026 Particle acquisition:

Q2 FY2026 Guidance

Full Year FY2026 Guidance

Particle Acquisition Impact

The company expects Particle to contribute:

- ARR: $20-22 million

- Revenue: $13-14 million

- Adjusted EBITDA: $1-2 million (FY26), growing to $5M in FY27 after synergies

Long-Term Targets

Management reiterated confidence in achieving $200 million in both ARR and Adjusted EBITDA over the next three years, with strategic acquisitions potentially accelerating this timeline.

What Changed From Last Quarter?

Several notable shifts from Q4 FY2025:

Key changes:

-

Gross margin compression: The 250 bps decline reflects product mix changes from the Jolt integration. The YoY comparison (+40 bps) is more meaningful.

-

Aggressive deleveraging: Digi paid down $24 million on the revolving credit facility, reducing outstanding debt to $135 million with $31 million cash on hand.

-

Accounting change: The inclusion of interest expense in adjusted metrics is a meaningful methodology shift that affects comparability with historical figures.

-

Particle announcement: The January 27, 2026 acquisition of Particle, a "leading provider of edge-to-cloud application infrastructure for intelligent devices," adds another ~$20M ARR.

How Did the Stock React?

DGII shares closed the regular session at $46.55, up 3.7% ahead of the earnings release. However, the stock dropped sharply to $41.00 in after-hours trading — down approximately 12% despite the double beat.

The after-hours selloff likely reflects:

- Gross margin contraction (62.4% vs 64.9% last quarter)

- Q2 guidance implying sequential slowdown in revenue momentum

- Concerns about acquisition integration and execution risk with two deals in 6 months

- Memory pricing pressure flagged by management due to AI infrastructure demand

- The stock's 2-year run from ~$22 to ~$47 pricing in much of the growth

Key Management Quotes

CEO Ron Konezny on the quarter's performance:

"We're off to a great start to our fiscal year 2026. Digi's customer focus is shining through our IoT solutions that drive meaningful ROI. With the addition of Jolt, we delivered double digit growth in ARR, revenue, adjusted EBITDA, and adjusted EPS in our fiscal first quarter."

On the demand environment:

"I think they're improving and increasing. I think we're all worried about how long the AI infrastructure buildout will sustain, but for now, it's been improving."

On the Particle acquisition strategy:

"What's attracted us to Particle, who we've known for several years now, is they were born this way. They were born as a service. And the processes, the way you go to market, the way you price your offering, the culture of the company is, I think, sometimes harder to appreciate that combination of things."

On profitable growth philosophy:

"Our game is not growth at all costs. It's profitable growth. We want to scale the business... When you get to $20 million of ARR, that's when you can really start thinking about that scale profitably."

On market dynamics:

"The market dynamics favor Digi's solutions as customers increasingly recognize that legacy 'set it and forget it' approaches no longer meet their operational requirements. Organizations are prioritizing connectivity and software capabilities as fundamental enablers of their strategic initiatives."

Q&A Highlights

The earnings call Q&A provided valuable color beyond the prepared remarks:

Demand Environment & Verticals

Management highlighted broad-based strength across verticals: "We're seeing a lot of success in mass transit and utility segments. We're also seeing a lot of success in retail digital signage. We also are seeing some success in data center as well, in particular their Opengear product line." CEO Konezny emphasized that cellular routers are now the fastest growing product line, with new products coming next quarter.

Memory Pricing Risk

A significant risk flagged on the call: the AI infrastructure buildout is creating pricing pressure on key components. "The AI push is putting a pressure on DDR4, DDR5 memory, as well as the MMC. So they're very specific memory components that are mainly in our newer products." Management noted that in some cases, POs are accepted with conditions that "price may be subject to change." However, Konezny expressed confidence: "We think we can navigate it. And we're going, in many cases, to alternate providers and having our engineering teams qualify those parts just to make sure we have more than one source of memory."

Competitive Landscape

On cellular routers and gateways, management noted favorable dynamics: "There's certain segments that are very, very concerned about having Chinese-originated parts, especially radios. They will literally open up a device and look to make sure that there's no Chinese-manufactured radios in particular." This positions Digi well in security-conscious U.S. segments while still offering "more price-competitive offerings" internationally.

Particle "Embedded-as-a-Service" Strategy

The Particle acquisition marks a strategic shift toward embedded solutions: "This really marks a foray into embedded-as-a-service, where a lot of times we're now going into an engineering department, and we're embedding that IoT solution inside of our customers' machines, whether they be spas or whether they be in the ag or industrial field." Enterprise customers include Jacuzzi, Goodyear, and Watsco.

Guidance Philosophy

CFO Jamie Loch explained their conservative approach: "As a rule, we have not increased an annual guide after the first fiscal quarter... it's a little bit more responsible to give yourself at least a mid-year point before traditionally we would do an operational raise." He noted the FY26 guide includes "about a 4-point lift" with "about 3 of those points are Particle" — implying ~1 point operational raise.

Jolt Integration Update

Both field integration and support services are tracking "right on track." CFO Loch noted: "The field teams have really done a great job being in the same space, understanding the offerings, collaborating, working through both their pipelines as well as a unified front with customers."

Gross Margin Outlook

CFO Loch expects continued margin expansion: "As ARR continues to grow at a rate that is at least on pace with revenue, you'll continue to see some margin expansion. Historically, we've seen sort of in that 10-15 basis point expansion sequentially."

Capital Allocation & Balance Sheet

Digi's capital priorities remain focused on deleveraging and strategic M&A:

The company repaid $24 million against the revolver during Q1. Management stated: "We intend to continue to deleverage the Company's balance sheet. Acquisitions remain a top capital priority for Digi."

Forward Catalysts & Risks

Catalysts to watch:

- Particle integration progress and synergy realization (expecting $5M EBITDA contribution in FY27)

- Continued ARR acceleration toward $200M target

- Industrial IoT demand driven by "AI adoption and software applications expansion"

- Potential additional acquisitions aligned with ARR and scale objectives

Risks flagged:

- Memory pricing pressure: AI infrastructure buildout creating supply constraints and price volatility on DDR4, DDR5, and MMC components used in newer products

- Integration risk from rapid M&A cadence (Jolt in Aug 2025, Particle in Jan 2026)

- "Inflationary and deflationary pressures" and potential recession concerns

- Supply chain challenges and regulatory risks including "potential expansion of tariffs"

- Uncertainty around how long the AI infrastructure buildout will sustain

- Cybersecurity and data privacy risks

The Bottom Line

Digi International delivered a strong Q1 with a clean double beat — setting all-time records for quarterly revenue ($122M), ARR ($157M), adjusted EBITDA ($32M), and EBITDA margin (25.8%). The recurring revenue transformation continues to gain momentum with the fifth consecutive quarter of double-digit ARR growth, now augmented by the Particle acquisition adding ~$20M ARR.

However, the sharp after-hours selloff (-12%) reflects investor concerns about:

- Gross margin compression (62.4% vs 64.9% last quarter)

- Memory pricing risk from AI infrastructure demand pressuring component costs

- Execution risk from two acquisitions in 6 months (Jolt and Particle)

- Valuation after the stock's 2-year run from ~$22 to ~$47

Management expressed confidence in the demand environment ("improving and increasing") and reiterated the path to $200M ARR/EBITDA by end of FY2028. The cellular router segment is "fastest growing" with new products coming next quarter.

Key numbers to remember:

- Revenue: $122M (+18% YoY)

- Adjusted EPS: $0.56 (+24% YoY)

- ARR: $157M (+31% YoY, fifth consecutive quarter of double-digit growth)

- Adjusted EBITDA margin: 25.8% (record)

- FY26 guidance: 14-18% revenue growth, 17-21% EBITDA growth

Analysis based on Digi International's Q1 FY2026 8-K filing and earnings call transcript dated February 4, 2026. Next earnings expected May 2026.